Mortgage Rates are Coming Down

Mortgage rates are coming down and why speaking to a mortgage specialist is beneficial in this evolving climate

The infamous mini budget in September 2022, during which mortgage rates reached a high of 6%, is now only a memory. The mortgage market has stabilised considerably since, with mortgage rates gently falling since the end of last year, and it is expected that this downward trend will continue for the next few months. In recent days sub 4% rates have been re-introduced back into the market, showing competition amongst lenders is strong.

The Bank of England base rate increase from 3.5% to 4% on 2 February was not unexpected, and thus has not shown to have a significant impact on mortgage product pricing. The Bank of England predict that inflation will "start to fall quickly this year” so as the market becomes more confident that inflation can be bought under control, we should expect to see the continuing reduction in mortgage rates.

However, when it comes to mortgages, rates are just part of the picture. Each mortgage lender has their own underwriting criteria, which is often extensive. According to Experian, lenders reject a third of customers using comparison sites as they do not meet their full lending criteria.

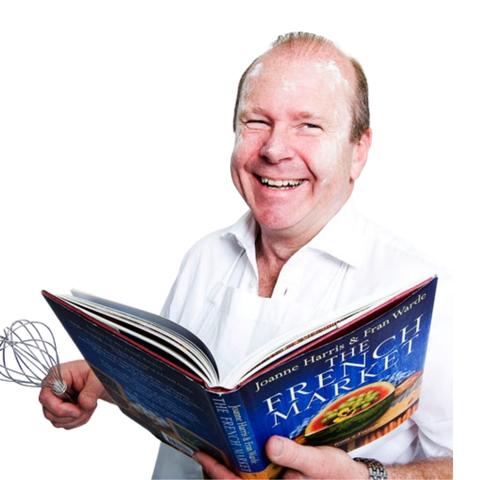

This is when speaking to a mortgage expert can help. At Springtide Capital their mortgage brokers will gather all the required information and documentation necessary from the client. They will take the time to fully understand the needs of each client, to conduct research with more than 100 lenders to find the most suitable deal. This process means that the broker will only present deals that you qualify for, preventing any unnecessary disappointment or incurring delays. Springtide Capital monitor all market variables closely providing valuable insight into market changes and trends.

Alongside your mortgage consultant, Springtide Capital will allocate you a dedicated case manager. They will ensure your application proceeds as smoothly and speedily as possible, they follow up with lenders through every step of the process. They can also liaise with third parties, such as solicitors to help remove stress from what is already a complicated process. “Our role is to make sure you never pay more than you need to, and we use current market knowledge to inform our decisions. Your mortgage consultant’s role doesn’t stop once a deal is complete, this a long-term partnership. We proactively monitor rates ahead of your renewal date to ensure you act quickly, at the right time, to get the right price.” Zoe Hatcliff, Mortgage Consultant Springtide Capital

Springtide Capital are Daniel Cobb’s chosen broker. We chose them due to them being independent and problem solvers. They are an important part of making sales transactions reach a positive outcome.

‘Information correct up to 23rd March 23’